Sep ira calculator growth

Discover Fidelitys Range of IRA Investment Options Exceptional Service. For comparison purposes Roth IRA and regular.

Ira Calculator See What You Ll Have Saved Dqydj

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

. Ad Ensure Your Investments Align with Your Goals. SEP IRAs SEP stands for Simplified Employee Pension plan and applies to employers not limited by number of employees. W-2 income would come from the business payroll records.

SEP IRA Personal Defined. Consider the costs of a conversion. Ready To Turn Your Savings Into Income.

This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to. Get Up To 600 When Funding A New IRA. Employer contributions for each eligible employee must be.

How to Calculate Amortization Expense. Sep ira calculator growth Jumat 02 September 2022 Edit. Explore Choices For Your IRA Now.

How to Read Your SEP IRA Calculator Results. Discover Bank Member FDIC. Its Never Too Early to Invest in Your Future.

The SIMPLE IRA calculators final result is a forecast of how much your SIMPLE IRA account will increase over the next five years. Unfortunately there are limits to how much you can save in an IRA. Not everyone is eligible to contribute this.

Ad Ensure Your Investments Align with Your Goals. And so are we. Calculate your earnings and more.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Use our IRA calculators to get the IRA numbers you need.

Get Up To 600 When Funding A New IRA. No plan tax filings with IRS. Employee notification of employers contribution.

Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Based only on the first 305000 of compensation for 2022 290000 for 2021 285000 for 2020 The same.

Find Out Which IRA Plan Works Best for You. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. IRA Distribution Calculator for Retirement Planning.

About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future. The ira calculator exactly as you see it above is 100 free. How to Calculate Self-Employment Tax.

Employers must fill out and retain Form 5305 SEP PDF in their records. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Each employee must open an individual.

Build Your Future With a Firm that has 85 Years of Investment Experience. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. How to Calculate Cost of Goods.

Searching for Financial Security. Currently you can save 6000 a yearor 7000 if youre 50 or older. When you purchase life and retirement.

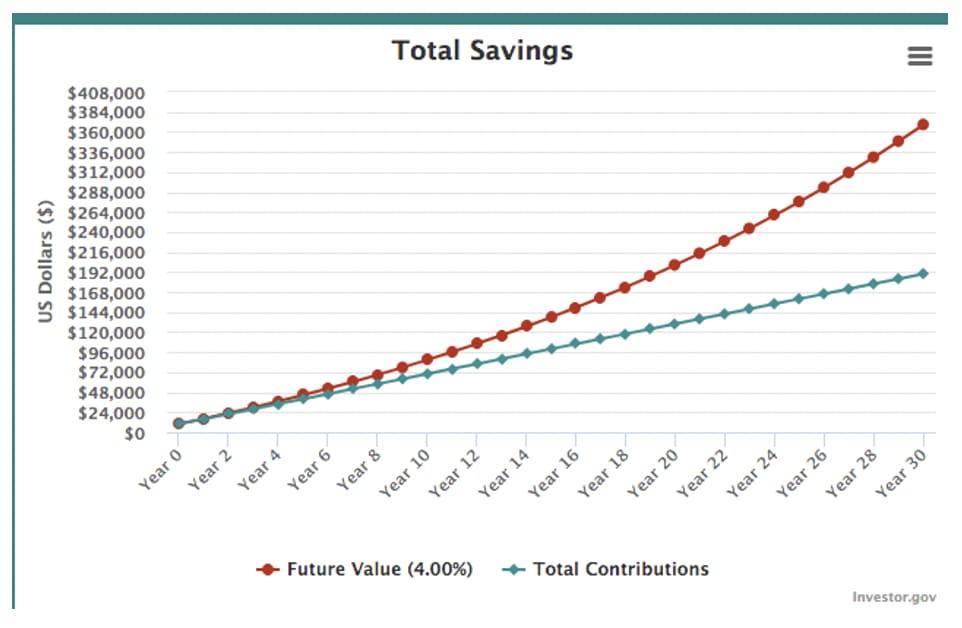

SIMPLE IRA 5-Year Growth Forecast. If your contributions are good your. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs.

Find a Dedicated Financial Advisor Now. Five-Year Growth Projection Rule of Thumb. Our Financial Advisors Offer a Wealth of Knowledge.

Our Financial Advisors Offer a Wealth of Knowledge. Use this calculator to determine your maximum. SEP or SIMPLE IRA or a defined.

This is computed by applying the maximum contribution at 20 of the maximum compensation level which is set at 285000 for 2020 whereas it was 280000 for the year. Searching for Financial Security. Use this calculator to determine your maximum contribution amount for a Self-Employed 401 k SIMPLE IRA and SEP.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Ad Explore Your Choices For Your IRA. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership.

While long-term savings in a Roth IRA may. Automated Investing With Tax-Smart Withdrawals. Suggested Employer SEP IRA Contribution.

Ad Open a Roth or Traditional IRA CD Today. Find a Dedicated Financial Advisor Now. Solo 401k Plans By Nabers Group Self Directed.

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

What Is A Sep Ira Sep Ira Contribution Limits Rules Guidedchoice

What Are Roth Ira Accounts Nerdwallet Self Employed Retirement Plans Individual Retirement Account Retirement Accounts

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Moaa Mid Year Tax Moves Retirement And Charitable Giving

How Notice 2022 6 Can Help 72 T Early Distribution Planning

Taxes After Retirement Tips For Keeping More Money

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Ira Vs 401 K Comparison Explanation Which To Choose

How A Custodial Ira Can Give Your Child A Head Start On Retirement Savings T Rowe Price

Contributing To Your Ira Start Early Know Your Limits Fidelity

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Retirement Growth Calculator Best Sale 57 Off Www Ingeniovirtual Com

Retirement Planning The Ultimate Guide For 2022